In the last 6 months, I have had about 15 clients preparing to leave the U.S. Several are headed to Costa Rica, one to Belize, and the others mostly Belgium and Switzerland. A couple of others are selling off all their worldly possessions and traveling the country, having sold their businesses and converted their belongings to cash.

In my practice, I am seeing a huge and fast occurring trend to simplify lives and, for lack of a better phrase, “get out of Dodge.” It is interesting to sit back and watch this occur. One would think the clients I am referring to are all affluent, but this is not the case. Some just want a different life, a simpler life with less rushing about. They are tired of being masters to large homes, caring for property, and owning more stuff than they can use.

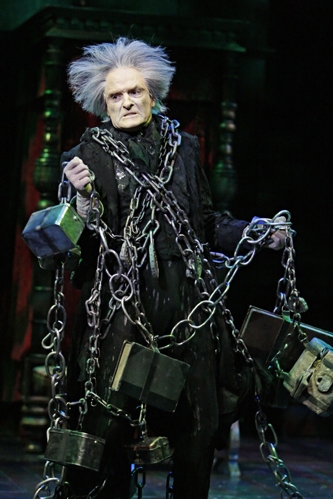

They are even growing tired of the items they inherited, making peace and letting them go too. From what I can tell, these heirlooms have become monkeys on their backs and they are doing something about it.

We have already seen this mindset in the younger generations X and Y. The millennials have a thought-process all their own; it seems they came into this world not wanting stuff at all. They prefer cash, not stuff.

The majority of my clients divesting themselves of nearly everything are 50+ years and see the writing on the wall. These decisions usually come after their last parent has passed away, and the children are either grown or on their own. They themselves are either retired or been let go of their jobs early, and having trouble finding a new one.

It might seem impulsive to many of you who may be aghast at the thought of selling your worldly possessions. But this group of people, which is growing rapidly (based on the phone calls I receive each day), knows

- they can’t take it with them,

- the market is not doing us any favors, and

- these things will be a burden to someone else someday.

I have followed up with many of these people, and here’s the kicker … They don’t regret a thing! They are so happy they let go of the very things that anchored them; now they are free to enjoy their lives and do what they really want to do.

Funny thing, “stuff.”

So many of us equate our success to the acquisition of stuff. Yet, in the end, it really doesn’t mean much because it cannot come with you.

Sure, we have our few favorite pieces we could never live without. We humans are creatures of habit. We only use 20% of what we own. Think about it! We wear our favorite clothes, favorite shoes and purses, and the rest just sits there. When is the last time you really enjoyed all of the items you brought back from mom’s house after she passed? Are they just sitting there on a shelf, kept but not truly cherished?

I am heeding my own advice and letting go of many things I spent 20+ years collecting. My husband is wondering why I am suddenly purging. It’s because we have too much, and we no longer want or need it. I’d rather have the cash, more space, and more time to enjoy myself!

©2014 The Estate Lady®

Julie Hall, The Estate Lady®, is the foremost national expert on personal property in estates, including liquidating, advising, and appraising. http://www.TheEstateLady.com She is also the Director of American Society of Estate Liquidators®, the national educational and resource organization for estate liquidation. http://www.aselonline.com.

No part of The Estate Lady® blogs, whole or partial, may be used without Julie Hall’s written consent. Email her at Julie@TheEstateLady.com.