I first published this article on The American Society of Estate Liquidators® (ASEL) website in October 2014. I thought you’d appreciate the information as you select a professional estate liquidator to help you downsize or clean out a parent’s home. If you’ve already used an ASEL liquidator, I’d love to hear your comments on the many hats they wear.

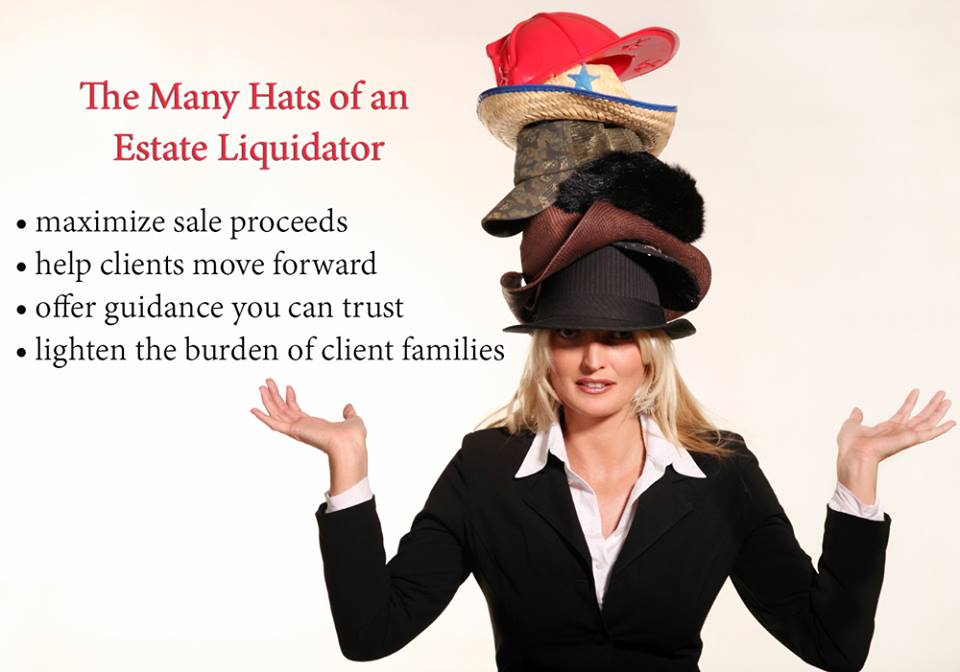

Many people are under the impression that an estate liquidator is someone who puts on glorified yard sales. Nothing could be further from the truth! Professional estate liquidators wear many hats on any given day with a common goal for their client as well as for themselves:

Many people are under the impression that an estate liquidator is someone who puts on glorified yard sales. Nothing could be further from the truth! Professional estate liquidators wear many hats on any given day with a common goal for their client as well as for themselves:

- to maximize sale proceeds,

- lighten the burden of our client families,

- treat each other with respect, and

- help our clients move forward.

In the process of doing so, we must possess a great deal of knowledge to guide our clients along the way. We don’t just organize and set up for a sale. We:

- clean items that haven’t seen the light of day in decades,

- tirelessly research these items,

- make calls to private buyers that we know will be interested in a particular item or collection,

- figure out the best way to set up to maximize the sale,

- price items appropriately,

- coordinate sending high-end items to proper selling venues,

- coordinate all crews,

- manage our clients, and the list goes on.

Often the client is not aware of just how much back-breaking work and time is invested before the door ever opens for the estate sale. We take 50, 60, 70 years of accumulation and sort through it, research it, clean it, organize it and sell it within a week or so. That’s amazing in and of itself! It is up to us to educate our clients so they do understand that we truly earn our commission and do our very best for them.

Below you find just a sampling of what professional estate liquidators engage in every single day, early mornings to late evenings, and seven days a week.

We have bled, sweat, and cried our way through some estates, and dealt with poor working conditions too. There isn’t much we’re afraid of; we tackle the task at hand like a linebacker.

We wear this challenging badge with honor because we love what we do, no matter how much we get beat up in the process.

Detective – We sort through years of long forgotten items that have been crammed in boxes and cubbies. Often family cannot find important papers (titles, Will) or a sentimental item, but many times we find them. We know where to look, have a good idea of where things could be hidden, and we know what these items are, or how to find out. This is the fun part!

Archeologist – We dig and dig and dig. By the end of the day, we are covered in dirt. We unearth one layer at a time searching for old artifacts and treasures. We handle carefully and lovingly the items we uncover which have value or meaning. This is painstaking, but necessary.

Magician – While it appears to the client that we made it all disappear as if by magic, we know the levels of complexity it takes to empty the estate. “Can you do a sale this weekend?” There is no magic. Only hard work, the ability to professionally multi-task, knowing the right people, and selecting the right staff.

Bellhop – Who’s carrying the family baggage; the client, you, or both? Stay focused and advise as necessary. Our ears are bent with family lore (and who did what to whom)!

Firefighter – Estate professionals put out fires every day, whether it comes from prospective buyers or the sellers, or anything in between, including the emotions our clients go through.

Police/Law Enforcement – We keep peace and order in these estates, enforce our ethical policies, “law down the law” according to the rules for how each sale should be run. These are in place to ensure a pleasant estate sale day, encourage good behavior, and keep the flow moving.

Counselor/Clergy – We listen, validate, encourage, support, and hear confessions and stories. It is part of our job to offer support, including emotional support within reason.

Accountant/Administrator – Pay the bills/employees, handle the contracts, handle brokering details, tally estate proceeds; we do it all.

Umpire – Calling “safe” and “out” for not only attendees and clients, but also monitoring our staff conduct and ourselves as well.

Train Conductor – We prevent derailment, get everyone on-board, and get the clients where they need to be.

Psychic – Can you predict human behavior based on all of your estate experience? Yes, you can. We’re very good at reading people and understanding motives.

Nurse/Doctor – Not only do we help heal many of our clients who are heavy laden and would have a very difficult time going through the process alone, we must remember the most important rule: First, do no harm. Clients come first. In the literal sense, we have all mastered first aid, as we bleed in nearly every estate!

Construction worker – We build this business from the ground up and create a very strong, honest/ethical foundation to weather the storms. If the foundation is not strong, we need to rebuild, remodel, tear down, or bring in a new addition.

Referee – Keeping the peace on all sides, at all times.

These are just a few of the many hats estate sale professionals wear on any given day, but there are many more that often go unnoticed; employer, exterminator, garbage man, dumpster gal, recycler, haul/drop-off person, organizer, companion, cleaning service, broker, miner, etc.

How much can one truly professional estate liquidator accomplish? It’s all in a day’s work!

©2014 The Estate Lady®

Julie Hall, The Estate Lady®, is the foremost national expert on personal property in estates, including liquidating, advising, and appraising. http://www.TheEstateLady.com She is also the Director of American Society of Estate Liquidators®, the national educational and resource organization for estate liquidation. http://www.aselonline.com.

No part of The Estate Lady® blogs, whole or partial, may be used without Julie Hall’s written consent. Email her at julie@theestatelady.com.