Personal property and heirlooms — we spend a lifetime accumulating them, inheriting them, caring for them, collecting them, and talking about them. But we rarely know the current values and we rarely make a plan for what happens to our personal property upon illness or death. Here are some serious mistakes that are being made:

Unrealistic expectations. Many elderly parents and their Boomer children feel their items are worth more than they actually are. Many believe their children will keep more than they actually do. Styles and lifestyles have changed dramatically and the younger generation is not buying what grandma and grandpa own.

Not knowing values before doing anything. Many Boomer children are hasty with their parents’ possessions. You wouldn’t believe what we pull out of dumpsters! Once a crisis occurs, such as an illness or death, heirlooms with value can end up in a dumpster or yard sale. They often decline to hire a personal property appraiser to ascertain what’s valuable before distribution and disposal. Know the values or someone else will.

Just because it is old, doesn’t mean it is valuable.

Underestimating the Process. If the home sells right away, how long would it take you to disassemble the house? It is a process that takes forethought and organization. It is overwhelming because people don’t know where to begin and it can stretch out into a very long and tedious process if distracted. It takes much longer than most people realize.

Waiting until a crisis situation occurs = Hasty Decisions. This is not advisable if you want to work with trusted resources and have the process flow smoothly. There needs to be a plan, if only for your own sanity.

Not making a plan for your possessions while you are here, as well as after your gone. Boomer children are left to make serious decisions often in the middle of a crisis, or worse. Feuding amongst themselves is common because no guidance was left for them. There also seems to be one child or sibling who believes they are entitled to the “lion’s share” or another that says, “Mom told me I could have that.” Have these conversations with your adult children or elderly parents today. Tip: Gift possessions while still living. This minimizes future feuds and offers joy to both the giver as well as the receiver.

Not thinning out the home as you age. The children are often blindsided (and even resentful) that nothing was done to thin out or begin the process while their parents were still living. Older parents should create a master wish list and ask what the heirs would like to have. It would be optimal if they could do this and then have values assigned by an objective professional so the children could at least divide the estate equitably. If adult children are willing to help de-clutter, let them.

Not researching companies or professionals to help you. Research the companies or professionals you are looking to hire. It is very important to conduct due diligence so you can have peace of mind later on.

Tip: Please do not go with the lowest possible commission. Professionals are not at all the same. One should compare their reputation, expertise, skill set, services, etc.

Not sharing final wishes and vital information prior to infirmity or death. Depression Era parents have a tendency to not share their final wishes with their children. Known as the “silent” generation, they don’t easily share vital documents, financial information, a copy of their Will/Trust (if they don’t have one that should be a top priority), and the location of all of these legal and personal documents, including location of keys, passwords or location of cash or jewelry.

Leave a legacy of love and preparation, not resentment.

©2017 The Estate Lady® Julie Hall, is a national expert in dealing with personal property in estates, including liquidating, advising, and appraising. http://www.TheEstateLady.com. She is also the Director of American Society of Estate Liquidators®, the national educational and resource organization for estate liquidation. http://www.aselonline.com.

No part of The Estate Lady® blogs, whole or partial, may be used without Julie Hall’s written consent. Email her at julie@theestatelady.com.

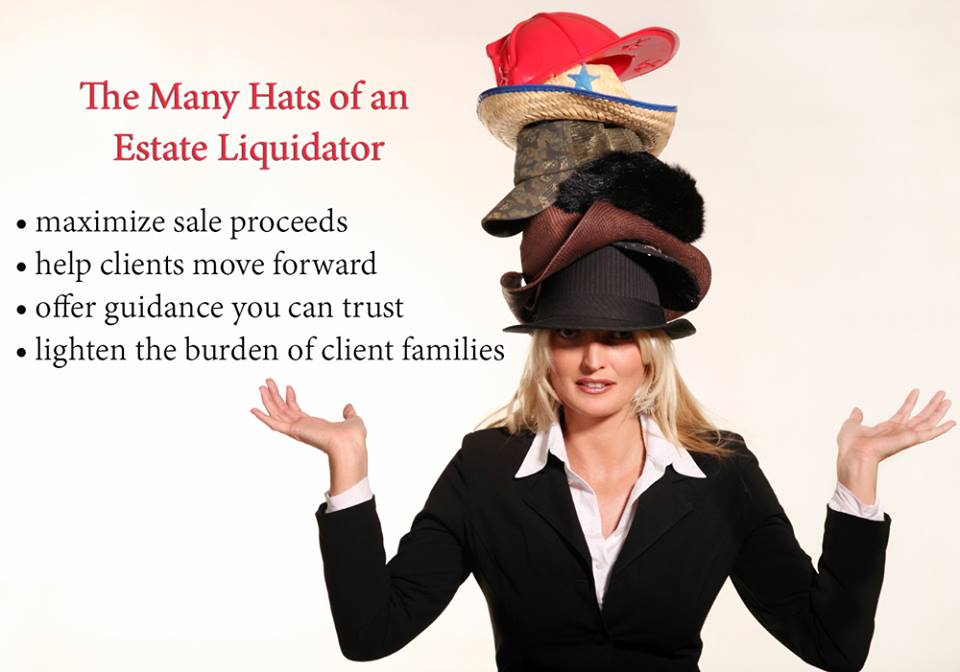

Many people are under the impression that an estate liquidator is someone who puts on glorified yard sales. Nothing could be further from the truth! Professional estate liquidators wear many hats on any given day with a common goal for their client as well as for themselves:

Many people are under the impression that an estate liquidator is someone who puts on glorified yard sales. Nothing could be further from the truth! Professional estate liquidators wear many hats on any given day with a common goal for their client as well as for themselves: