Louise was a wealthy woman in her advanced stages of a terminal illness, was blind, completely deaf, and in her final stage of dementia. She could no longer communicate and decisions were being made for her by an old friend she trusted. Louise had never married and had no children, but did have four beneficiaries to her estate. All four really loved her and provided the very best care for her in a beautiful health center for the remainder of her days.

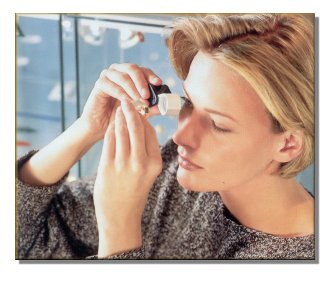

One of Louise’s passions in life was purchasing fine diamonds; she had several pieces that were very large and easily worth in the six-figure range. Everyday, she wore them because she loved them. Louise bathed in them, napped in them, slept in them, and ate in them.

The beneficiaries started to grow concerned about these pieces of jewelry Louise wore on her person, for a number of reasons.

- Most people don’t even have pieces as valuable as these, and if they did, the pieces would be kept in a safe, vault, or safe deposit box.

- The beneficiaries did the right thing in requesting the rings be removed while Louise was napping, to have the genuine diamonds replaced with less expensive stones, in the event something should happen to the rings.

- The genuine diamonds would then have been turned over to the trustee of the estate and secured. Who could possibly blame them for wanting the diamonds protected?

Unfortunately, the decision-maker overseeing Louise’s assets insisted that Louise should continue to wear those massive stones against everyone’s advice.

One day, less than 2 weeks after this request to have each diamond removed and replaced with cubic zirconia, the massive diamond pieces Louise was wearing disappeared. Not only did these pieces disappear, but a video camera, some CDs and a crock put vanished as well from Louise’s home. This was a clear indication to the family that the caregiver, sitter, or someone else who had very close contact with her, had made off with the goods. The beneficiaries were beside themselves.

Why didn’t anyone prevent this from happening?

Why didn’t anyone listen to their request?

With all the questions and accusations that flew, the damage was done. The diamonds were gone, never to be found again, probably sold at a pawn shop for a few thousand dollars and currently sitting in someone’s safe as their own retirement investment.

It is simply up to us, the chosen decision-makers,

to make the correct decisions to care for and

protect our loved ones (and their assets)

who cannot make decisions for themselves.

This story clearly demonstrates that we must exercise extreme caution with valuables. Remember to have them evaluated by a professional, have those values documented, and keep them in a safe place until they are either distributed to family or sold. The faces of exploitation are often familiar faces and not necessarily a stranger.

©2015 The Estate Lady®

Julie Hall, The Estate Lady®, is the foremost national expert on personal property in estates, including liquidating, advising, and appraising. http://www.TheEstateLady.com She is also the Director of American Society of Estate Liquidators®, the national educational and resource organization for estate liquidation. http://www.aselonline.com.

No part of The Estate Lady® blogs, whole or partial, may be used without Julie Hall’s written consent. Email her at Julie@TheEstateLady.com.