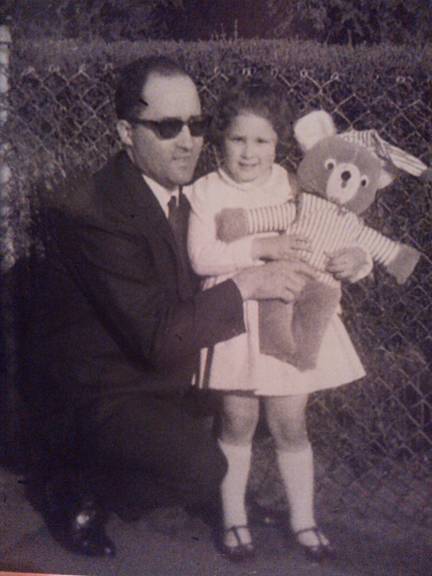

Nearly 50 years have passed since this photo was taken. Yet I can tell you the occasion and the color of my dress, shoes, beloved teddy bear, and dad’s sunglasses. He seemed as large as life to me; every time I looked up at dad, I felt like I was staring into the sun. His hands were big, rough, and strong. Strong enough to discipline us kids when we needed it, strong enough to pick us up when we fell and guide us when we grew. When he was old and fragile, we used to walk hand in hand, his being much smaller and bony with the ravages of time, in my own strong hands that I inherited from him. We would walk and I would listen to his stories of long ago.

On this day in the photo, Dad had given me this teddy bear, my new best friend, donning 1960s style red and white pajamas. If I recall the family story, dad bought it off the back of a truck in New York City where he used to work. I didn’t care where he got it. It was a gift from him. That made it really special, even all these years later, and especially now that he’s gone.

I do not have a clear recollection of where Teddy ever ended up, whether it was to a younger cousin or given to the church yard sale, but that old bear was loved and brought me lots of joy. A special memory shared between a father and a daughter!

I struggle sometimes on the inside when my heart is hurting because of loved ones that have passed, and how much I feel their loss. They are truly missed.

Even though they are gone, their spirit – the essence of who they were – isn’t gone!

They walk with me each day in my thoughts and I hold them dear. You have relatives like that too.

We don’t need to take all their stuff after they pass and load up our own homes and lives in order to remember them. Their stuff is still just stuff.

What makes their stuff special is who owned it, who used it, who loved it, or who gave it!

There is a season for every thing. Sometimes, it’s the season to give their things to others who can really use the stuff or really need it far more than we do.

I can’t speak for any of you; this photo and the memory attached to it are a gift to only me … a snippet of a moment in my life and my father’s. I ask you, could there possibly be any tangible item more special than that?

A diamond ring will sparkle only as long as you are here to enjoy it. Money, houses, or cars can’t go with you either. But a special memory sits in the heart forever. That, my friends, is exactly what you can take with you!

©2014 The Estate Lady®

Julie Hall, The Estate Lady®, is the foremost national expert on personal property in estates, including liquidating, advising, and appraising. http://www.TheEstateLady.com She is also the Director of American Society of Estate Liquidators®, the national educational and resource organization for estate liquidation. http://www.aselonline.com.

No part of The Estate Lady® blogs, whole or partial, may be used without Julie Hall’s written consent. Email her at Julie@TheEstateLady.com.